Please note that the article doesn’t present investment advice and serves for educational purposes only.

Disclaimer: All trademarks, logos, and brand names are the property of their respective owners. Screenshots are used solely for informational and educational purposes under fair use. This content is not sponsored or affiliated with the platforms depicted unless explicitly stated.

The Perpetual Protocol (PERP) token is one of many decentralized finance (DeFi) assets that emerged during the DeFi boom of 2020. As interest in crypto derivatives continues to evolve, some traders are asking whether PERP can regain its former momentum. This article offers a detailed Perpetual Protocol PERP price prediction for 2025, 2027, 2030, 2035, and 2040 based on current data and historical trends. Please note that all forecasts are speculative and should not be taken as financial advice. Before diving into the perpetual protocol price prediction, it’s important to understand the fundamentals: what is PERP in crypto?

What Is Perpetual Protocol (PERP)?

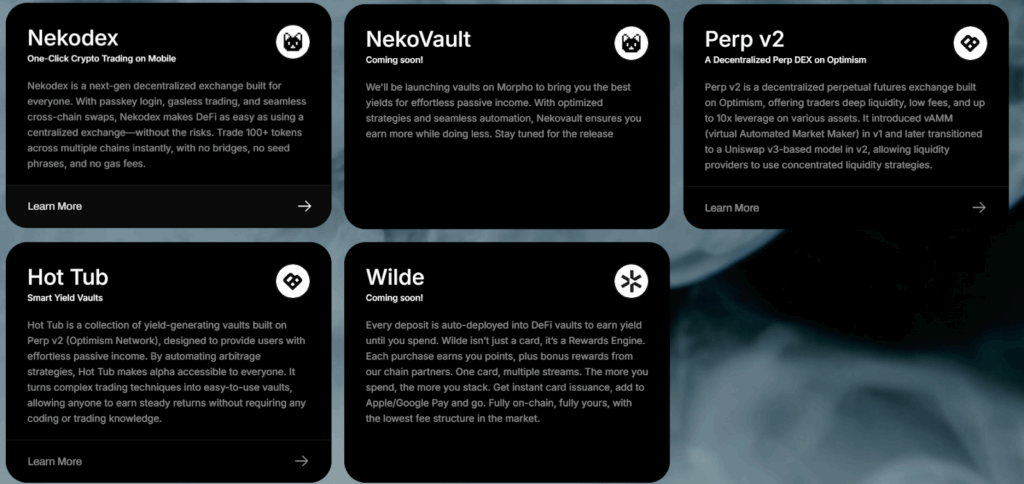

Perpetual Protocol is a decentralized exchange (DEX) focused on futures trading. It enables users to go long or short on crypto assets like BTC, ETH, and DOT with up to 10x leverage. Unlike traditional order book models used by centralized exchanges, Perpetual Protocol operates through a virtual automated market maker (vAMM), a mechanism that simulates liquidity and pricing without relying on actual counterparties.

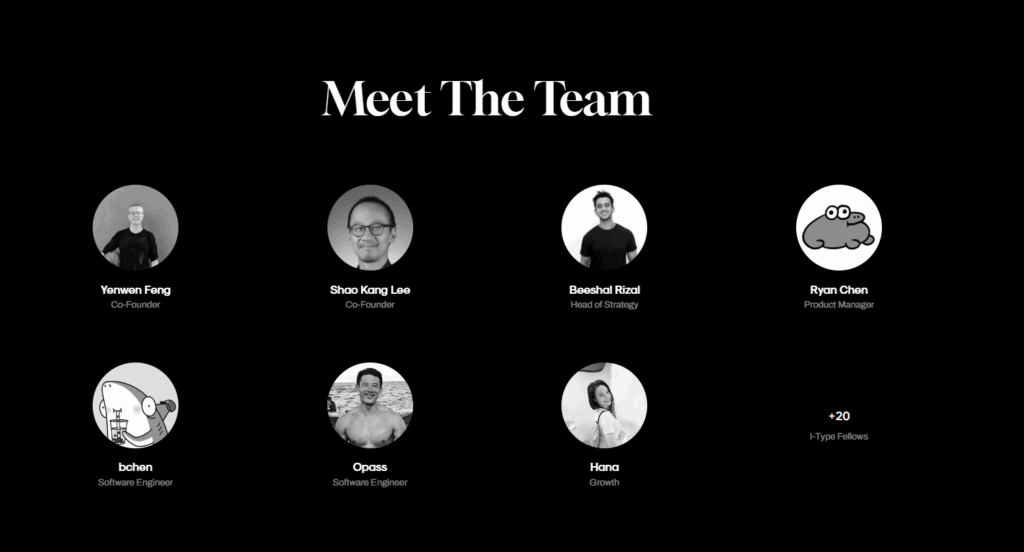

Launched by Yenfen Weng and Shao-Kang Lee in 2020, the protocol was developed by a Taiwan-based team and backed by investors such as Multicoin Capital, Binance Labs, and Alameda Research. PERP, the platform’s native token, is used for governance and staking within the ecosystem.

Perpetual Protocol’s infrastructure was initially built on Ethereum and xDai, allowing for on-chain trading and non-custodial asset management. Trades are settled in USDC, and the protocol also supports gas-free deposits for larger transactions.

The project aims to create a fully decentralized, accessible derivatives platform. By using the vAMM model, it avoids traditional liquidity pools, instead balancing prices through algorithmic design. Future plans include expansion to other blockchains and the introduction of new trading features.

Understanding these core mechanics is essential before reviewing any perpetual protocol price prediction or evaluating its potential in the evolving DeFi market.

Perpetual Protocol (PERP) Price Prediction for 2025, 2027, 2030, 2035, 2040

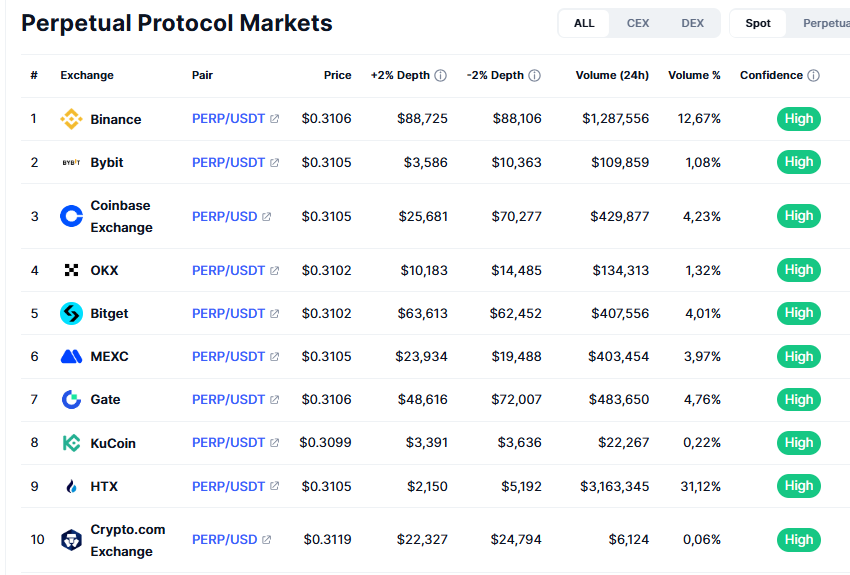

As of July 28, 2025, the price of Perpetual Protocol (PERP) stands at $0.31, with a market capitalization of $20.44 million. This places the token around the 886th position in CoinMarketCap’s global ranking.

The following forecast is based on a combination of fundamental and technical analysis. For a detailed overview, see the breakdown provided below the table.

| Year | Price Prediction | ROI of your investment (if you buy the coin now) |

| 2025 | $0.41 | 32.26% |

| 2027 | $0.35 | 12.90% |

| 2030 | $0.61 | 96.77% |

| 2035 | $1 | 222.58% |

| 2040 | $1.5 | 383.87% |

2025

In 2025, the overall crypto market is expected to benefit from increased institutional interest and global regulatory clarity. Innovations in decentralized finance (DeFi), including the rise of on-chain derivatives platforms, are likely to boost attention toward projects like Perpetual Protocol. As traders look for decentralized alternatives to traditional futures markets, PERP could see moderate growth. However, competition in the derivatives space remains high, which may limit short-term momentum. According to our forecast, the PERP token may reach $0.41 by the end of 2025.

2027

The year 2027 may mark a period of increased volatility ahead of the 2028 Bitcoin halving. Historically, this pre-halving phase has seen subdued market enthusiasm and pullbacks across many tokens. With limited fresh capital entering the space and risk sentiment possibly turning cautious, DeFi tokens like PERP could temporarily decline. Unless the protocol introduces major updates or new incentives for liquidity providers and traders, we project PERP might fall to around $0.35 by late 2027.

2030

Following the 2028 Bitcoin halving, the crypto market is projected to enter another growth cycle by 2029–2030. As decentralized derivatives trading becomes more mainstream and integrated into cross-chain ecosystems, Perpetual Protocol could regain traction. Assuming continued development and adoption, PERP could recover and gradually increase in value. We estimate the token may reach approximately $0.61 by the end of 2030.

2035

By 2035, crypto finance could be significantly more regulated and integrated with global financial infrastructure. If Perpetual Protocol remains compliant, secure, and continues innovating within DeFi, it may become a widely used trading platform. The increased demand for non-custodial financial tools could elevate its value. Under favorable conditions, PERP could potentially climb to $1.

2040

Looking 15 years ahead, projecting price movements becomes more speculative. Still, if DeFi cements its role in the global economy and Perpetual Protocol adapts to evolving market needs, PERP could benefit from increased adoption. In an optimistic scenario, we estimate its price may reach $1.50 by 2040.

Perpetual Protocol (PERP) Price Analysis for the Past Several Years

Let’s explore the historical price movements of the PERP token and the key events that influenced its performance. Keep in mind that past performance does not guarantee future results.

| Date | Price | Why the price dropped/rose to this level (what influenced the price change) |

| Sep 1, 2020 | $1.57 | On September 1, 2020, Perpetual Protocol launched its token (PERP) during the height of DeFi summer. The token initially traded at around $1.57 as investors showed interest in decentralized perpetual contracts. PERP gained traction from early adopters curious about on-chain derivatives, but market saturation limited further momentum in the short term. |

| Jan 30, 2021 | $6.42 | By late January 2021, PERP experienced significant upward movement as the broader crypto market rallied. Growing enthusiasm for DeFi protocols and the launch of key liquidity mining programs helped PERP climb to $6.42. Investor optimism around decentralized derivatives played a crucial role in the token’s rise during this period. |

| May 10, 2021 | $10.34 | On May 10, 2021, PERP hit a new high of $10.34. This surge aligned with a bull run driven by increased Ethereum adoption, institutional investments, and demand for permissionless trading products. The announcement of Perpetual Protocol v2 and improved capital efficiency also sparked renewed investor interest. |

| Jul 20, 2021 | $5.08 | Mid-2021 brought a market correction across crypto. By July 20, PERP had fallen to $5.08 due to negative sentiment surrounding regulatory crackdowns in China and uncertainty around the future of DeFi protocols. Despite the price drop, development on the protocol continued steadily. |

| Nov 10, 2021 | $24.84 | November 2021 marked PERP’s all-time high of $24.84. This price spike was fueled by overall crypto euphoria, high trading volume on the platform, and a thriving DeFi environment. PERP benefited from broader market gains as Bitcoin and Ethereum reached record levels, lifting altcoins across the board. |

| Jun 15, 2022 | $0.95 | In June 2022, the crypto market faced one of its harshest downturns. Following the Terra ecosystem collapse and tightening macroeconomic conditions, PERP dropped sharply to $0.95. Liquidity dried up, and DeFi protocols saw significant outflows, impacting tokens like PERP. |

| Oct 3, 2024 | $1.28 | By October 3, 2024, PERP had shown modest recovery, trading at $1.28. Improvements to protocol efficiency and market expectations of a potential altseason in 2025 contributed to cautious optimism. However, the token remained far below its all-time high, with resistance levels around $2 proving difficult to breach. |

Q&A

Is PERP a good investment?

This article does not constitute investment advice. The information provided is for informational purposes only. Please conduct your own research and consider consulting a financial advisor before making any investment decisions.

What will be the PERP price in 10 years?

According to our Perpetual Protocol (PERP) price prediction, the token could reach approximately $0.61 by 2035, assuming moderate project development and steady adoption in the DeFi space. This forecast is based on current trends and market conditions but is subject to change due to volatility and broader economic shifts.

Should you buy PERP now?

Although some members of the CoinMarketCap community maintain a bullish sentiment, PERP is still trading significantly below its all-time high. At this stage, the token remains a high-risk asset, and its growth potential is uncertain. A more prudent approach may be to wait for clearer market signals — possibly during the next altseason in 2025 — and conduct thorough technical and fundamental analysis before deciding to invest.

Conclusion

Perpetual Protocol has carved out a niche in the decentralized derivatives space, offering an alternative to traditional trading platforms. Its future depends on broader market conditions, user adoption, and ongoing development. As with any crypto project, potential investors should weigh both risks and opportunities before making financial decisions.

Related

Stay tuned

Subscribe for weekly updates from our blog. Promise you will not get emails any more often.

Most Popular

New Posts

Stay tuned

Subscribe for weekly updates from our blog. Promise you will not get emails any more often.